From Follower to Leader

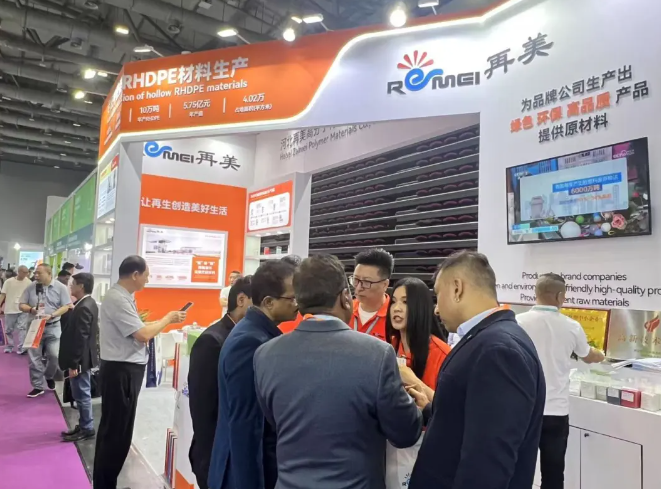

The year 2025 has marked a pivotal breakthrough for China's recycled plastics industry, which has now definitively transformed from a global follower into a leading force, actively reshaping the sector's landscape through comprehensive policy, technological innovation, and dynamic market evolution; exemplifying this shift, industry benchmark Remei Polymer has proactively obtained 11 National Standard certifications—including the Design Guidelines for Recyclable and Recycled Plastics—thereby not only witnessing but also driving this green transition, as China moves from implementing standards to setting them and propelling the global circular economy forward through systemic innovation and integrated value-chain development.

I. Policy-Driven Transformation: From "Following" to "Leading"

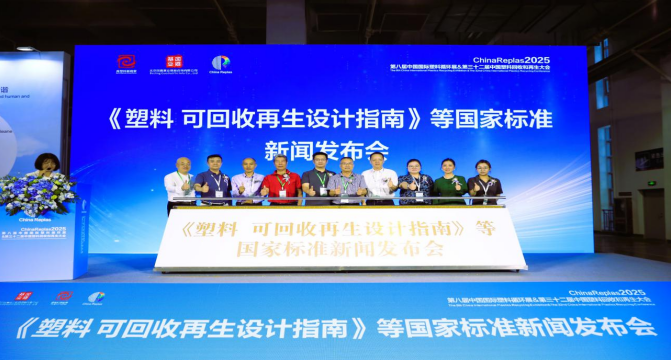

1. Implementation of a Full-Chain Standardization System

Eleven national standards, including the Design Guidelines for Recyclable Plastics released in September 2025, cover the entire lifecycle from product design, recycling, and regeneration to application. They establish a clear recyclability grading framework, promoting source reduction and improved recycling efficiency.

The Limits on Hazardous Substances in Recycled Plastics, effective from February 2026, sets strict limits for the first time on heavy metals, flame retardants, and other hazardous substances, filling gaps in safety regulations and laying the foundation for industry standardization.

2. Legislation Mandating the Use of Recycled Materials

Article 987 of the Ecological Environment Code (Draft) stipulates that "the state shall establish a system mandating the use of recycled materials in key product categories," accelerating the green transformation of high-pollution industries such as packaging, automotive, and electronics.

II. Market Breakthroughs: Scaling Up and Moving Up the Value Chain

1. Structural Adjustments in Production Capacity and Utilization Rates

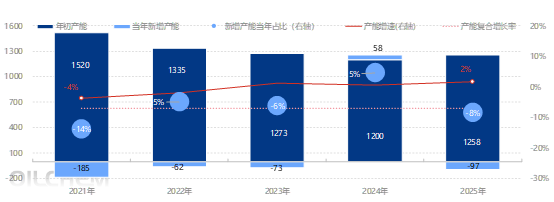

Industry capacity data (2021–2025) reveals:

Initial capacity initially contracted before stabilizing: starting at 15.2 million tons in 2021, dropping to 12 million tons in 2024, and recovering to 12.58 million tons in 2025.

Annual new capacity has experienced negative growth for consecutive years (from -1.85 million tons in 2021 to -0.97 million tons in 2025), signaling an industry shift toward "capacity reduction."

The initial capacity utilization rate gradually recovered from -14% in 2021 to -8% in 2025. Capacity growth slowed from -4% in 2021 to 2% in 2025. The gap between the compound annual growth rate (20%) and the actual growth rate reflects the industry's transition from "expansion" to "quality improvement."

2.Dynamic Changes in Recycling Volumes and Inventory

Monthly inventory data for 2025 shows:

Inventory for a specific category of recycled plastics increased initially before stabilizing from January to September 2025. It peaked at 2.93 million tons in April, a 67.9% year-on-year increase, before gradually declining to 3.65 million tons.

Inventory growth hit a low in June (-14%) before slightly rebounding, indicating a shift in market demand from "accumulation" to "absorption."

3.Key Categories and Price Trends

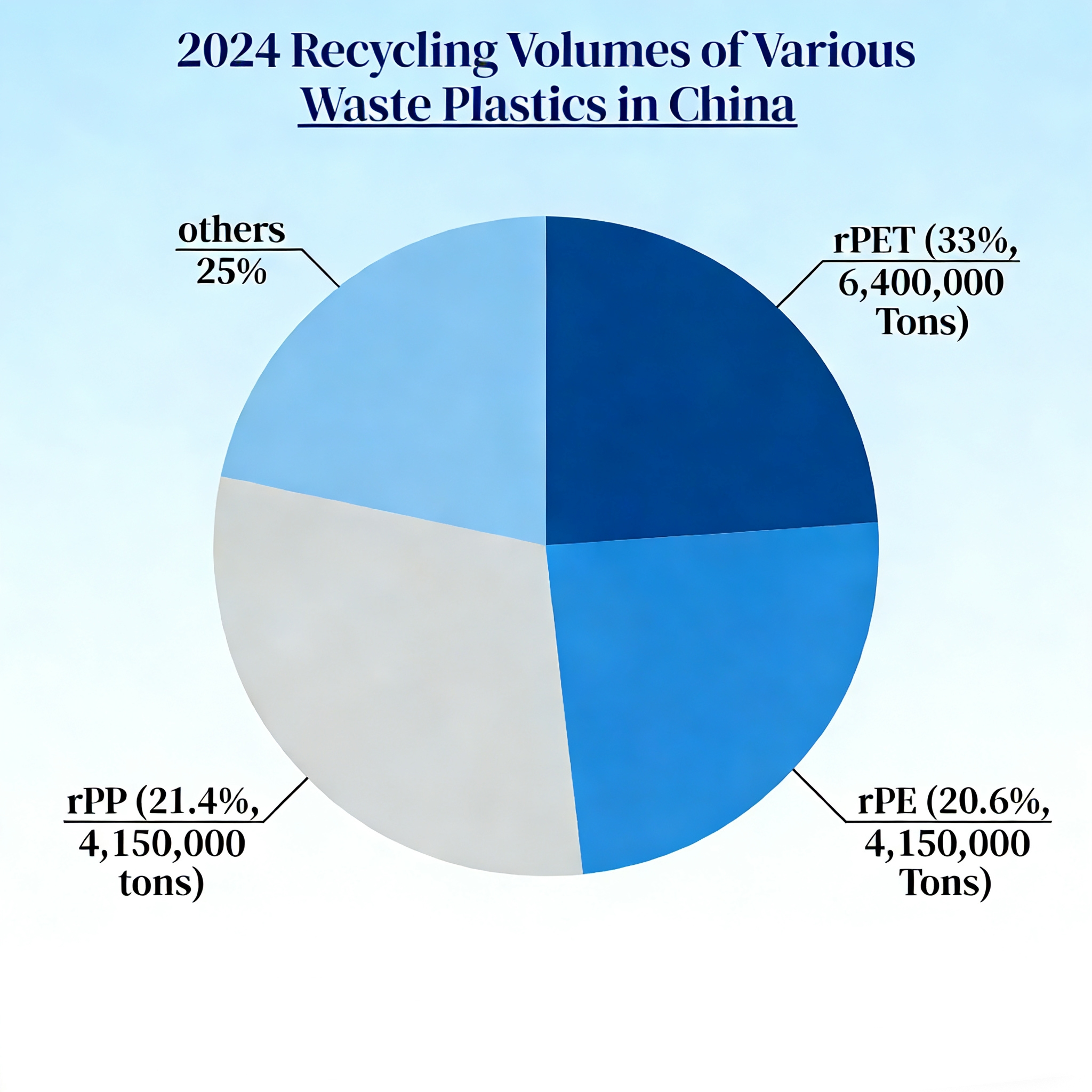

Market data on recycling volume shares in 2024 shows:

China's waste plastic recycling volume is expected to exceed 20 million tons in 2025, with recycled plastics production shifting toward higher quality. Major categories include PET (33%, 6.4 million tons), PE (4.1 million tons), and PP (4.15 million tons), collectively accounting for 75% of total recycling volume. PET recycling reached a rate of 33%.

Price Reference for Q4 2025

(Price fluctuations have narrowed, influenced by low virgin material prices):

- Hebei Recycled PE Price(Which is the Representative prices in the Chinese domestic recycled plastics market): RMB 5,700 – 6,000 /ton

- JU TOWN(An important indicator of the price trend for plastic PE in gobal plastics product market) Pellets: RMB 5,400 – 5,700 /ton

- Hebei WAHAHA White Pellets(Due to its market representativeness,generality of raw material and process,wide downstream application,and price transparency as an important price reference indicator): RMB 5,200 – 5,400 /ton

III. Trend Insights: Technological Innovation and Global Competition

1. Technological Breakthroughs Reshaping the Value Chain

Intelligent Sorting and Modification Technologies: Processes such as nanofiltration and two-stage masterbatch pelletizing have increased the purity of recycled HDPE to 99.5%. Key performance indicators (e.g., tensile strength ≥20 MPa) now approach virgin material levels, enabling entry into high-value sectors like automotive and construction.

Acceleration of Chemical Recycling Commercialization: Globally, chemical recycling projects under construction increased by 70% year-on-year. Leading Chinese enterprises are accelerating their deployment, overcoming the quality limitations of traditional physical recycling.

2. Global Competition and Regional Restructuring

The EU Carbon Border Adjustment Mechanism (CBAM) is pushing Chinese enterprises to improve the quality of recycled materials. Some production capacity has shifted to Southeast Asia, but low-end capacity in the region only accounts for 18% of China's market share.

Domestic policies are driving industry consolidation, with 60% of national capacity concentrated in East and South China. Leading enterprises are expanding their market share through compliance advantages and technological barriers.

IV. Recommendations for European Partners

1. High-End Positioning and Technological Collaboration

Focus on high-value sectors such as new energy vehicles and medical industries. Collaborate with Chinese enterprises to develop high-performance recycled materials (e.g., FDA-certified food-grade recycled plastics).

2. Become a Supplier of High-Quality Products

Leverage China's standardized production system to provide high-purity, traceable recycled plastics that meet the EU's Packaging and Packaging Waste Regulation (PPWR) requirements for recycled content (30% by 2030).

3. Procure Recycled Materials to Gain a Cost Advantage

Although recycled materials are 10% more expensive than virgin materials, comprehensive benefits are significant through EU tariff reductions (up to 30%) and long-term cost optimization. For example, the environmental attributes of RHDPE can help avoid a plastic tax of 0.8 euros per kilogram.

Conclusion

China's recycled plastics industry is transitioning from "scale expansion" to a "quality revolution." After the implementation of new standards in 2026, high-quality production capacity will become the core competitiveness. Zaimet is committed to collaborating with European partners to share the dividends of green technology and jointly explore new frontiers in the global circular economy. For 2025 price fluctuation data and capacity analysis, feel free to reach out anytime!

RecycledPlastics #CircularEconomy #SustainableDevelopment

#ChinaEUCollaboration

—Remei Team Let regeneration create a better life!

Leave a reply